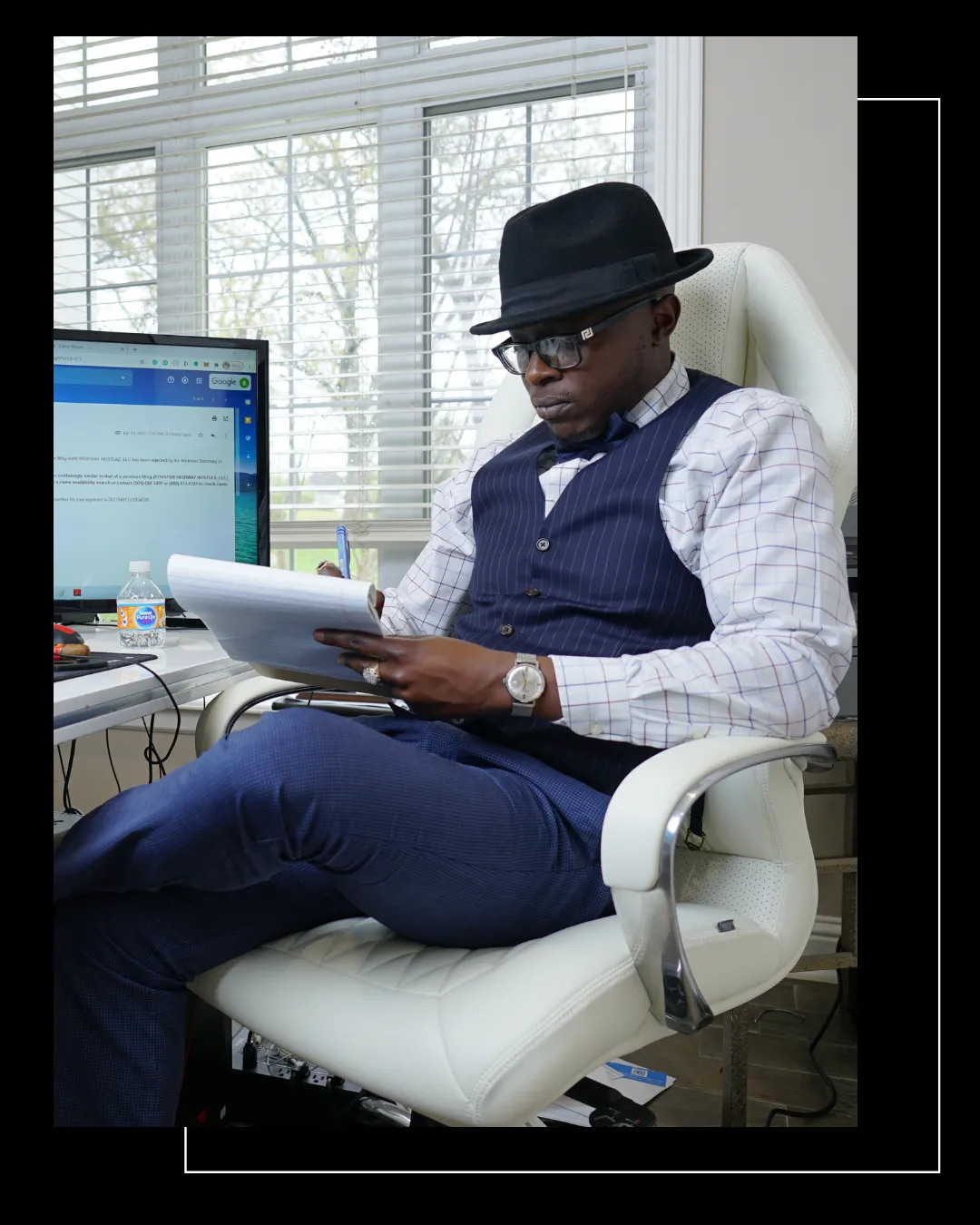

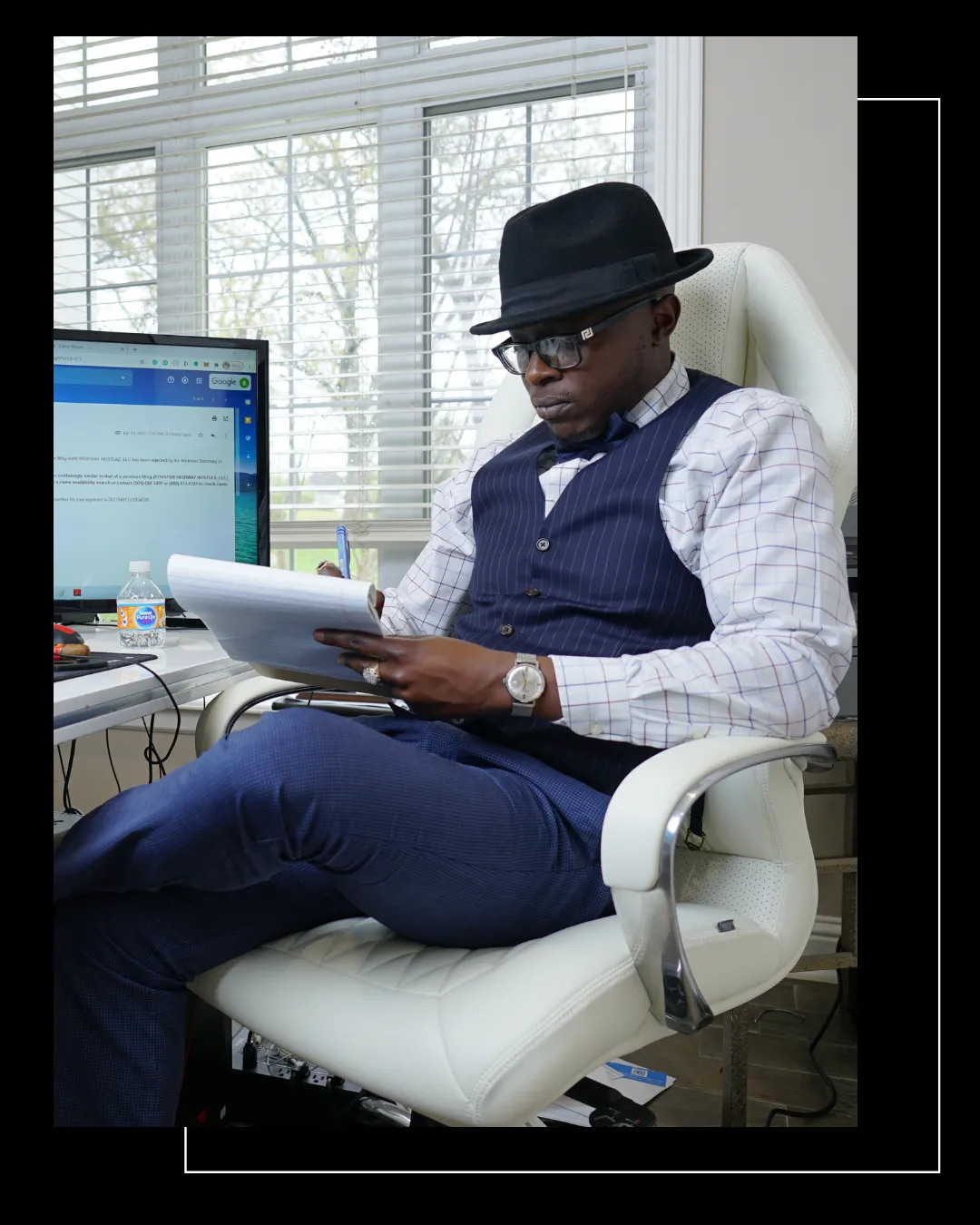

Help Others Achieve Financial Freedom with Expert Credit Consulting

Are you passionate about helping others with their credit-related issues?

The Credit Consulting Academy is the perfect course for you.

Credit repair refers to the process of improving your credit score and credit report by taking steps to remove errors, inaccuracies, or negative information that may be impacting the credit score. This can be done by disputing incorrect information on the credit report, negotiating with creditors to remove negative information, and taking steps to improve credit habits and behaviors. Of course, there are companies you can hire to fix your credit. Actually, with our Sister company Pennington Consulting Group, we have helped thousands remove negative items off their credit and increase credit scores. We have also developed a course to empower those who wish to fix their own credit.

This comprehensive course covers a wide range of topics

credit reporting

credit scoring

credit repair

debt management

We are going to walk you through the steps and empower you with the knowledge to get this done. This includes:

1. Review reading and understanding your credit report and the 5 factors that are used to evaluate your score.

2. Disputing errors: If you find any errors or inaccuracies on your credit report, you can dispute them with our proven formula and dispute letters.

3. Negotiating with creditors: If you have negative information on your credit report that is accurate, you may be able to negotiate with the creditor to have the information removed in exchange for paying off the debt.

4. Improving credit habits: To improve your credit score in the long term, it's important to develop good credit habits such as making payments on time, keeping credit utilization low, and avoiding opening too many new credit accounts at once.

SIGN UP HERE TO GET ON THE WAITING LIST FOR THIS COURSE

The launch date is March 30, 2025

© 2025 GUIDING LIGHT MISSION. ALL RIGHTS RESERVED.